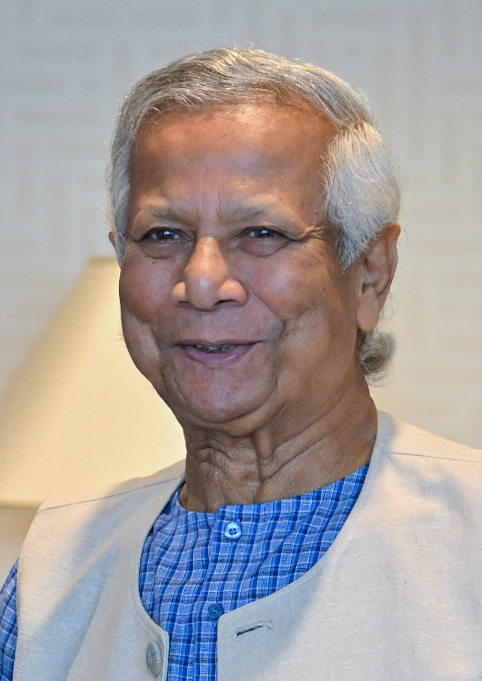

Muhammad Yunus: Transforming Poverty Through Grameen Bank's Microcredit Empowerment

Muhammad Yunus grew up in the bustling village of Hathazari in what is now Bangladesh, surrounded by a community where resourcefulness defined daily life. Born in 1940 as the third of 14 children to a hardworking family in the jewelry trade, he witnessed firsthand the cycles of hardship that limited opportunities for many.

Origins of Microfinance and Early Innovations

His early education in local schools instilled a deep appreciation for knowledge, leading him to pursue higher studies in economics at Dhaka University. There, Yunus excelled, earning top honors and developing a passion for understanding economic systems that could uplift societies. After completing his doctorate in the United States at Vanderbilt University, he returned to his homeland in 1972, eager to apply theoretical insights to real world challenges. Joining Chittagong University as an economics professor, he began teaching while observing the devastating effects of poverty in rural areas. The 1974 famine that gripped the country sharpened his focus, prompting him to explore practical solutions beyond traditional aid. Yunus started small experiments, lending modest sums from his own pocket to women weavers in nearby villages, discovering that access to even tiny amounts of capital could spark productive activities and break poverty traps. This hands on approach revealed the flaws in conventional banking, which overlooked the poor due to lack of collateral. By 1976, these informal loans had grown into a formal initiative, leading to the establishment of the Grameen Bank in 1983 as an independent institution dedicated to serving the unbanked. Yunus’s model emphasized group lending, where borrowers formed accountability circles, fostering trust and mutual support without requiring physical assets. This innovation not only provided financial access but also built social capital, empowering women who formed the majority of clients to take control of their economic futures. His expertise in economics, combined with empathy for grassroots realities, crafted a system that prioritized sustainability over charity, ensuring loans were repaid at high rates through tailored repayment plans. Yunus’s vision transformed microfinance from a fringe idea into a viable tool for development, influencing how financial services reached marginalized populations. The Grameen Bank’s rapid expansion to thousands of branches demonstrated scalable impact, lifting families out of destitution by supporting ventures like poultry farming and handicrafts. His early work highlighted the potential of finance as a catalyst for human dignity, setting a foundation for global replication. Through rigorous documentation of outcomes, Yunus proved that the poor were reliable borrowers when given fair terms, challenging outdated assumptions and inspiring a new paradigm in economic inclusion.

The evolution of Yunus’s microfinance model during the 1980s and 1990s showcased its adaptability and profound effects on community structures. As Grameen Bank proliferated across Bangladesh, it introduced features like savings programs that encouraged financial discipline among borrowers, creating a cycle of accumulation rather than debt. Yunus’s emphasis on women’s empowerment was central, with over 90 percent of clients being female, enabling them to invest in education for their children and improve household nutrition. This focus yielded measurable results, such as increased school enrollment and better health indicators in served areas. Yunus collaborated with international organizations to refine methodologies, incorporating health and education components into loan packages, which holistic support further amplified economic gains. His book, Banker to the Poor, published in 1999, detailed these successes, drawing global attention and encouraging adaptations in diverse contexts from Latin America to Africa. Yunus’s advocacy for low interest rates, often below five percent, ensured affordability, while the bank’s nonprofit status kept profits reinvested in expansion. This structure sustained growth, reaching millions and reducing dependency on external funding. Yunus’s expertise influenced policy dialogues, prompting governments to recognize microfinance’s role in national development plans. The 2006 Nobel Peace Prize awarded to Yunus and Grameen Bank validated these efforts, spotlighting microcredit’s capacity to foster peace through economic stability. His innovations extended to technology, piloting mobile banking to reach remote villages, enhancing efficiency and inclusion. Yunus’s commitment to transparency through regular audits built credibility, attracting partnerships that scaled the model internationally. These developments not only alleviated poverty for countless families but also demonstrated finance’s power to nurture entrepreneurship, inspiring a generation of social innovators. The Grameen approach’s emphasis on borrower ownership empowered communities to sustain progress independently, creating lasting resilience. Yunus’s forward thinking addressed broader issues like climate vulnerability by funding resilient agriculture, ensuring economic tools adapted to environmental challenges. His work reshaped perceptions of the poor as active economic agents, influencing curricula in universities worldwide and equipping future economists with practical frameworks for inclusive growth. Through persistent refinement, Yunus turned microfinance into a beacon of hope, proving that targeted financial access could unlock human potential on a massive scale.

The Grameen Bank’s success under Yunus’s guidance extended to urban areas, adapting microfinance for diverse needs like small retail operations, which boosted local economies and created employment ripples. His initiatives in education, such as scholarship funds from loan profits, ensured knowledge transfer across generations, breaking intergenerational poverty.

Yunus’s international outreach through the Yunus Centre amplified microfinance’s global footprint, training practitioners from over 100 countries in sustainable models that respected local customs. This knowledge sharing fostered autonomous institutions, spreading economic empowerment far beyond Bangladesh. His collaborations with corporations introduced social business concepts, where profit motives aligned with social goals, influencing hybrid enterprises worldwide.

The broader implications of Yunus’s early work lie in its demonstration of scalable, people centered economics, where finance serves as a bridge to opportunity rather than a barrier. His legacy continues to guide efforts in building equitable financial systems.

Muhammad Yunus’s vision extended beyond microfinance to the concept of social business, a framework he developed in the early 2000s to address systemic issues through enterprise driven solutions. Collaborating with Nobel laureate economist Amartya Sen, Yunus refined ideas that treated poverty as a denial of opportunity, advocating models where businesses reinvest profits to solve problems like healthcare access and environmental degradation. The Yunus Centre, established in 2007, became a hub for innovation, launching ventures such as Grameen Danone Foods, which produced affordable yogurt fortified with nutrients for malnourished children in Bangladesh. This partnership blended corporate expertise with social aims, creating jobs while improving nutrition in underserved areas. Yunus’s expertise influenced the creation of over 50 social businesses globally, from solar energy firms in Africa to waste management enterprises in Asia, each designed for sustainability without dividend distributions to investors. His annual Global Social Business Summit gathered leaders to share strategies, fostering a network that accelerated adoption in developing regions.

Yunus’s books, including Creating a World Without Poverty, outlined blueprints for these models, inspiring universities to integrate social entrepreneurship into programs. His advocacy for impact investing encouraged foundations to fund ventures that measured success by lives improved, not just returns. In healthcare, Yunus supported initiatives like Grameen Kalyan, providing low cost clinics that integrated microloans for treatment, enhancing preventive care and economic stability. This holistic approach addressed root causes, reducing vulnerability to illness induced poverty. Yunus’s work with international bodies like the United Nations promoted microfinance in sustainable development goals, embedding financial inclusion in global agendas. His emphasis on youth involvement through training programs equipped young leaders with tools to launch community focused enterprises, ensuring continuity. The positive outcomes included millions gaining access to clean energy and education, demonstrating social business’s viability. Yunus’s personal engagement, from field visits to policy advocacy, built trust and momentum, influencing corporations to pivot toward purpose driven operations. Through these expansions, Yunus’s expertise created ecosystems where innovation met compassion, uplifting communities and redefining economic progress.

Yunus’s outreach efforts gained traction through partnerships with educational institutions, offering scholarships and curricula on social finance that prepared students for impactful careers. These programs extended microfinance principles to disaster prone areas, funding resilient livelihoods.

The integration of technology in Yunus’s models, like mobile apps for loan tracking, streamlined services and reached isolated populations, enhancing efficiency and adoption rates. This adaptation highlighted his forward thinking in leveraging digital tools for greater reach.

Yunus’s contributions have profoundly shaped poverty alleviation strategies, with microfinance institutions modeled on Grameen serving over 200 million clients worldwide by the 2020s. His insistence on gender focus empowered women entrepreneurs, leading to higher family incomes and community stability in regions like South Asia and sub Saharan Africa. Yunus’s social business framework inspired hybrid organizations that tackled issues from sanitation to renewable energy, generating sustainable employment and environmental benefits. His global summits facilitated knowledge exchange, enabling local adaptations that respected cultural contexts while maintaining core principles of accessibility. The Yunus Centre’s research arm documented successes, providing data that guided policymakers in integrating microfinance into national budgets. Yunus’s Nobel recognition amplified these efforts, drawing investment and talent to the field, while his lectures at forums like the World Economic Forum elevated discussions on inclusive economics. Through Grameen America’s U.S. operations, he extended the model to urban poor, supporting immigrant businesses and fostering integration. His advocacy for regulatory reforms ensured microfinance remained borrower friendly, preventing exploitative practices elsewhere. Yunus’s personal story of returning to academia after international acclaim underscored dedication, inspiring professionals to prioritize service over prestige. The ripple effects include reduced child labor and improved literacy, as financial stability enabled education investments. His collaborations with tech firms introduced blockchain for transparent transactions, enhancing trust in remote lending. Yunus’s emphasis on metrics like repayment rates above 97 percent proved the model’s reliability, attracting ethical capital. This legacy continues to influence development aid, shifting focus from handouts to hand ups that build autonomy.

Building on microfinance, Yunus’s social businesses addressed climate challenges, funding eco friendly agriculture that sustained yields in vulnerable areas. These ventures created green jobs, aligning economic growth with planetary health and inspiring similar initiatives globally.

Yunus’s educational outreach through online platforms democratized access to entrepreneurship training, reaching aspiring leaders in remote corners and multiplying the impact of his ideas. His work with cooperatives strengthened community bonds, turning individual loans into collective progress.

The comprehensive reach of Yunus’s innovations lies in their adaptability, from rural Bangladesh to urban centers, proving that targeted finance can spark widespread transformation. His blueprint for empowerment endures as a testament to thoughtful, compassionate economics.

Yunus’s lifelong dedication to eradicating poverty through innovative finance has woven a tapestry of opportunity across continents, where the once excluded now thrive as entrepreneurs. From the humble beginnings in Jobra village, where he first lent 27 dollars to 42 women, his ideas blossomed into a global movement that redefined development. Grameen Bank’s evolution into a network of over 9 million borrowers showcases the power of trust based lending, with stories of transformed lives from market vendors to farmers illustrating tangible upliftment. Yunus’s social business ventures, exceeding 100 worldwide, tackle multifaceted challenges like affordable housing and digital literacy, ensuring profits fuel further good. His partnerships with international philanthropists mobilized billions, funding expansions that reached conflict zones and natural disaster aftermaths.

His influence permeates academia, with courses on social entrepreneurship drawing from his methodologies to train future change makers. Yunus’s emphasis on women’s leadership has elevated female participation in economies, from boardrooms to village councils, fostering balanced progress. Technological integrations, like biometric verification for loans, have minimized fraud and maximized inclusion, adapting to modern demands. The Global Alliance for Banking on Women, inspired by his work, supports female led enterprises, amplifying gender equity. Yunus’s personal resilience, overcoming institutional hurdles to institutionalize microcredit, motivates those facing barriers in their pursuits. His books and documentaries have educated millions, sparking grassroots movements that replicate Grameen principles locally. The positive economic multipliers, such as increased GDP contributions from microenterprises, underscore the model’s efficiency. Yunus’s vision for a poverty free world through accessible finance continues to guide organizations, proving that expertise rooted in empathy can yield exponential benefits. This enduring framework empowers individuals to author their destinies, creating societies where opportunity knows no bounds.

The lasting influence of Yunus’s microfinance extends to health sectors, where loan linked insurance schemes have improved outcomes for low income families, reducing financial shocks from medical needs. His models promote preventive care, building healthier communities overall.

Yunus’s global training programs have equipped over a million practitioners, ensuring his methodologies evolve with local needs and sustain long term impact. These efforts bridge cultural divides, adapting tools for diverse economic landscapes.

Yunus’s collaborative spirit with academia and NGOs has fortified research on poverty dynamics, yielding insights that refine financial inclusion strategies worldwide. His work exemplifies how one person’s insight can ignite collective advancement.